Turkey VAT Service

Looking to expand your e-commerce business to Turkey, here is FZCO’s guide to VAT service in Turkey.

VAT registration in Turkey

If you’re selling digital services and products to customers in Turkey, then you might be liable for Turkey’s Value-added Tax (VAT). This guide covers two very important parts of the system:

- Registering for the tax, and then

- Filing tax returns on time.

It’s important to note that VAT rates in Turkey can vary depending on the type of goods or services you provide, so it’s important to understand the rules and regulations for your particular business. It may also be a good idea to consult with a tax professional who can provide guidance on the registration process and ongoing VAT compliance requirements

How to register for VAT in Turkey

To register for VAT (Value Added Tax) in Turkey as a foreign company, you will need to follow these steps:

Determine if you are required to register: If you are engaging in taxable activities in Turkey, such as selling goods or providing services, and your annual turnover exceeds the threshold of TRY 5,000,000 (approximately USD 590,000), you are required to register for VAT.

- Obtain a tax identification number: If you do not have a tax identification number in Turkey, you will need to apply for one. You can apply for a tax identification number through the Turkish tax authorities.

- Prepare your registration documents: The documents you will need to provide may vary depending on your business activities, but typically include:

- Tax identification number

- Company registration documents

- A copy of your passport or other identification

- Details of your business activities in Turkey

- Bank account details

- Submit your registration application

- Wait for approval

Once you are registered for VAT, you will be required to collect VAT on your taxable sales and remit it to the tax authorities on a regular basis (usually monthly or quarterly).

How to file VAT returns in Turkey

To file VAT (Value Added Tax) returns in Turkey, you will need to follow these steps:

Collect VAT invoices and receipts: Keep track of all VAT invoices and receipts related to your business activities.

2. Calculate the amount of VAT owed: Subtract the VAT you paid on purchases and expenses from the VAT you collected on sales to determine the amount of VAT you owe.

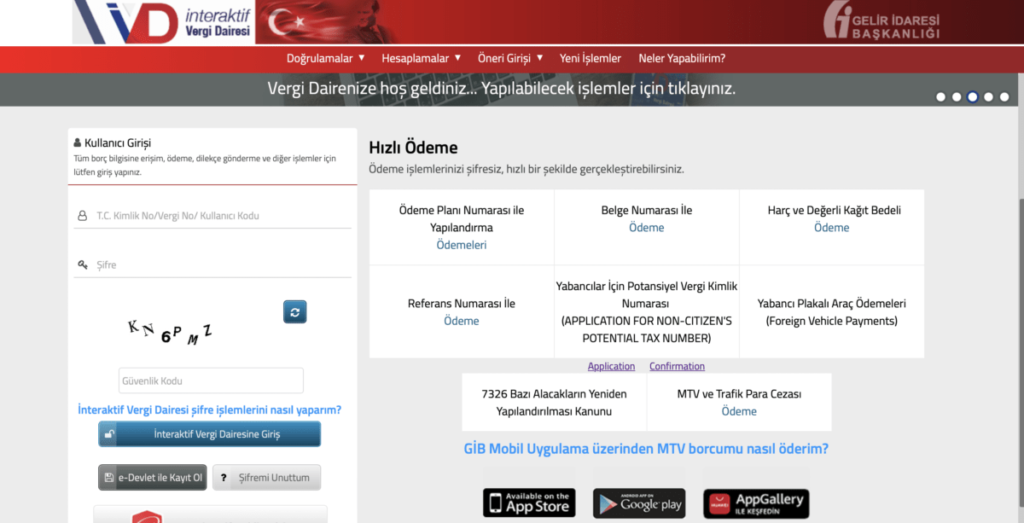

3. Fill out the VAT return form: You can access the VAT return form on the website of the Turkish Revenue Administration (TRA). The form will require you to enter the total amount of VAT collected, the total amount of VAT paid, and the net VAT owed.

4. Submit the VAT return: You can submit the VAT return form online through the TRA’s website or in person at the local tax office. The deadline for submitting VAT returns is the 26th day of the following month for monthly returns or the last day of the third month for quarterly returns.

VAT Payment for VAT filing

If you owe VAT, you will need to pay it by the deadline specified on the VAT return form. You can pay the VAT online through the TRA’s website or in person at the local tax office.

It’s important to keep accurate records of your VAT invoices and receipts, as well as your VAT returns and payments. Failure to comply with VAT regulations in Turkey can result in penalties and fines. If you are unsure about how to file your VAT returns or have any questions about VAT compliance, it may be a good idea to consult with a tax professional.